How foreign direct investment affects international real estate economics?

Table of Contents

Introduction

International real estate economics is a transaction that happens across national borders regarding real estate. Moreover, there will be several factors that include in this concept. One of the significant aspects is the supply and demand of real estate in different countries. And their impact on the global market real estate prices. Further, there are many fields included in this concept, including finance, law, geography, and urban planning.

Most importantly, all these areas are vital to study to understand global trends and investment opportunities. In this blog, we have covered foreign direct investment’s FDI effects on international real estate economics. So let’s explore all the areas in-depth detail.

FDI Effect on International real estate Economics

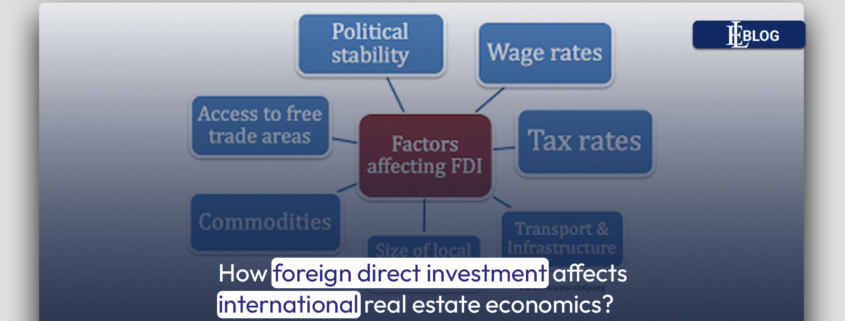

The FDI is the foreign direct index, which is the amount we receive from a foreign entity. Moreover, it is viable in contributing to and boosting the country’s economy. Here are some detailed insights into how FDI works in real estate economics.

Enhanced Demand for Properties

The FDI can help increase the demand for real estate projects in any country. Further, it can help raise investment rates and property prices. And that will, in return, benefit the investors and developers. Lastly, it will work beneficially for the entire construction industry.

Real Estate Financing

Foreign direct investment helps international real estate economics as it finances the realtors in creating real estate development projects in countries where the projects are scarce. Moreover, real estate economics and finance work more efficiently with the availability of the FDI. Also, it helps the local developer in creating outstanding real estate projects. And that will lead to enhancing the living standards of the investors.

Technology Transfer

The other aspect that works for the betterment of the country is technology transfer. Moreover, the FDI brings the latest technological advancement to the particular country. And not only these new practices in creating a global standard of living and commercial spaces. So, overall it helps not only enhance the infrastructural quality in the country but also helps investors attain long-term living standards.

Employment & Business Opportunities

The FDI brings employment prospects for the people in the country. Moreover, international real estate economics works as a helping hand in uplifting the living standards of the people. The job opportunities in the real estate fields include construction, property management, and real estate sales. All these areas need human resources that will be helpful in employment prospects for investors.

Commercial Real Estate Economics will also play a significant role here. Moreover, the corporate developments will help the investors start any business opportunity that will, in return, make high profits.

Boost Economic Growth

Foreign direct investment helps in boosting the country’s economy. Especially for underdeveloped and developing countries, it works miraculously. Further, if we look at the real estate condition in developing countries like Pakistan, FDI is now the need of the hour. FDI directly affects the country’s real estate sector as many developing housing projects are increasing economic stability and helping investors achieve desirable investment opportunities. Blue World City, New City Paradise, and Kingdom Valley Islamabad are the finest examples.

Diversification

Lastly, the most vital aspect is that FDI brings various practices to Pakistan. Moreover, the country has several examples, like the Seven Wonders City Islamabad with seven wonder replicas. The other model will be the Blue World City Islamabad, which is developing in collating with foreign developers. So, its infrastructure has unique features and is also known as Pakistan’s first purpose-built tourist housing society.

Potential Risks

The FDI in international real estate economics has potential risks that can diversly affect the economy and the country. And here are the details.

Dependency & Volatility

Too much foreign direct investment might make the country’s economy depend on this investment prospect, destabilizing the real estate markets. Moreover, as we know, the real estate industry is volatile. FDI might diversely affect the demand for real estate projects. Further, optimal FDI is sufficient to maintain real estate’s supply and demand ratio.

Currency & Political Risk

Foreign Direct Investment might become subject to political risk if there is political instability or government change, then the government policies. At the same time, currency fluctuations directly affect the FDI. That has a diverse influence on the return on investment for all foreign investors.

Conclusion

International Real Estate Economics is often affected and linked with foreign direct investment. Moreover, the FDi brings many prospects to the receiving country, where it only creates a high-quality infrastructure but also helps enhance the investors living standards. Further, the areas we have discussed in the blog suggest how FDI plays a significant role in the betterment of the country. Nevertheless, there are a few hazards involved in the price as well.

Better and wise planning is necessary to make the most of the FDI. Lastly, Estate Land Marketing always brings intriguing topics for all viewers and investors. So please keep visiting our website and contacting our real estate consultants for reliable guidance and updates.